Cornerstone

Mental Health Treatment Insurance Coverage

Answering your questions about residential or inpatient mental health treatment coverage

Coverage for behavioral health Residential Rehab

At Cornerstone, we understand the complexities of mental health challenges, recognizing how they affect the mind, body, and emotions. We know navigating insurance specifics when seeking residential or inpatient mental health treatment can be confusing. We have compiled a comprehensive list of responses to the most frequent mental health rehab coverage inquiries.

Our mental health programs are tailored to address the evident symptoms and the deep-rooted causes, ensuring a comprehensive approach to mental well-being.

We employ evidence-based methodologies to guarantee profound and sustainable healing. We also acknowledge the financial pressures that come with seeking behavioral health treatment. The encouraging news is that numerous health insurance providers, acknowledging our commitment to top-tier care, cover our mental health treatment centers.

Insurance Providers for Behavioral Health

At our behavioral health residential center, most UMR insurance plans are accepted.

Our behavioral health residential facility accepts most Meritain Health insurance plans.

Our mental health residential center welcomes a majority of Carelon Health plans.

We recognize most Magellan Health insurance plans at our behavioral health residential center.

Will my health insurance cover residential mental health treatment?

Understanding health insurance can be complex, especially when exploring coverage for a behavioral health facility. Fortunately, insurance is mandated to cover behavioral health treatment by federal law1. It’s vital to note that insurance policies have discretion in determining which specific treatments they will cover. The coverage can differ based on your plan, the insurance company, and the state. Examining your insurance details or consulting with your insurance provider to understand what’s included is essential. At Cornerstone, our admissions team assists individuals to verify mental health insurance benefits, ensuring they can access the behavioral health treatment programs they need without undue financial stress.

How do I use my health insurance mental health coverage?

Using health insurance for mental health rehab can significantly reduce costs or, in some instances, cover them entirely. We’re here to assist if you want to utilize your health insurance benefits. You always have the option to reach out to your insurance provider and gather specifics about your policy’s coverages. However, if you’d prefer to bypass the hassle and save time, complete our insurance verification form or contact our admissions team. We’ll handle the verification of benefits for you or your loved one. Once we’ve obtained your insurance verification, we will have detailed insights regarding your coverages and deductibles. You can arrange admission to a mental health treatment facility with this information.

Frequently Asked Questions

General coverage Questions

-

Which specific types of treatment are covered?

Mental health treatment insurance coverage levels vary across insurance plans. Usually, insurance companies will provide coverage based on medical necessity. Mental health treatment center admissions staff will often conduct a quick assessment to see what treatment is needed. Based off of those assessments, your policy may cover inpatient or residential programs at behavioral health treatment facilities, sometimes with stipulations. Some insurance companies might lean towards outpatient treatments due to cost-effectiveness and flexibility. Every insurance policy is unique, and you must verify your benefits to see what's included and any special requirements.

-

Are all mental health treatment levels of care covered?

The Mental Health Parity and Addiction Equity Act (MHPAEA)1 from 2008 ensures that health insurance plans provide comparable benefits for mental health and substance use treatments to general medical care. Still, nuances in coverage persist. For instance, specific policies may set different coverage parameters depending on the severity of the mental health symptom, the type of disorder, or the recommended treatment approach. Someone exhibiting intense symptoms of a specific mental disorder might be entitled to more extended treatment coverage than someone with milder symptoms. To get a clear picture, reviewing your insurance specifics or consulting your provider is essential.

-

Does my plan cover both short-term and long-term treatments?

Mental health coverage intricacies are tied to the specifics of your insurance plan. Some plans may focus on short-term interventions, like crisis stabilization or an initial round of therapy or psychiatric sessions. Conversely, long-term treatments encompass prolonged therapy over months, years, or extended stays in behavioral health facilities. For those exhibiting severe and life-affecting symptoms who are a danger to themselves or others, insurance companies will likely provide coverage for inpatient or residential stays, whether short or long-term. Many insurance policies cover short-term and long-term care, recognizing the importance of comprehensive mental health intervention. However, limitations do exist. For instance, there may be a cap on the duration of inpatient care or a yearly limit on therapy sessions.

-

What are the benefits of going to an in-network mental health facility?

Choosing an in-network facility offers multiple benefits. A primary advantage is the potential for more affordable treatment. Opting for an in-network facility usually results in your insurance covering a more substantial part of the expenses, often leaving you with just a minimal copay. The administrative side is also streamlined; with most of the billing intricacies managed between the facility and your insurer, you're spared from extensive paperwork. Additionally, insurance companies typically scrutinize in-network facilities, assuring you of the quality care you'll access. To maximize your benefits and ensure cost-effectiveness, submit an insurance verification to learn about our in-network affiliations specific to your insurance plan.

-

What are the benefits of going to an out-of-network facility?

If a mental health treatment facility is "out-of-network," it indicates that there isn't a preferential pricing arrangement with your insurance provider. Opting for such a facility could lead to higher expenses since your insurance may not reimburse as comprehensively as it would for an "in-network" facility. This might mean footing a heftier part of the treatment bill, or in some instances, your insurance might not contribute at all. However, it's essential to note that being out-of-network doesn't equate to inferior care. Some out-of-network facilities may offer exemplary treatments that are potentially more beneficial. Even though the immediate costs might be higher, the caliber of care and increased likelihood of a successful recovery could justify the additional investment. When evaluating an out-of-network mental health rehab, it's crucial to balance the potential treatment benefits with the associated costs.

-

What is the duration of treatment covered by my insurance?

The duration of health insurance coverage for mental health varies based on your specific insurance policy. While some plans might cover just a few weeks in a mental health facility, others could extend to several months or even longer for therapy sessions. A critical concept here is "medical necessity." Insurance providers rely on this term to determine the extent of treatment coverage. When a medical professional deems the treatment important for your well-being, it's necessary. Therefore, if prolonged treatment is advised, insurance is more likely to support it. However, each insurance policy has distinct criteria.

Treatment Coverage Details

-

Do I need pre-approval to get admitted to a mental health facility?

Often you'll need prior authorization or approval from your insurance company before being admitted to a mental health facility. This is to ensure that the treatment being sought is considered "medically necessary" by the insurance company's standards. The facility or your healthcare provider can typically assist in obtaining this authorization by conducting an assessment and communicating with your insurance. However, in emergency situations, an individual might be admitted immediately, with authorization and details sorted out after stabilization. Our admissions team can find out this information for you and we have the assessments in place to ensure that you can get admitted quickly.

-

Does my insurance require a referral from a provider to enter into a facility?

Whether your insurance requires a referral from a provider to enter a mental health treatment center varies based on your specific insurance policy and plan. Many insurance plans, especially HMOs (Health Maintenance Organizations), require a referral from a primary care physician or another medical professional before covering specialized services, including mental health treatment facilities. PPOs (Preferred Provider Organizations) and other plan types might offer more flexibility, not necessitating a referral. To be certain, it's best to review your insurance documentation or contact us directly to understand if a referral is needed for mental health facility admissions.

-

Are aftercare or follow-up services included in my coverage?

After concluding primary treatment for mental health issues, post-treatment services play an essential role in maintaining well-being and progress. Such services can range from continued therapy sessions to support group meetings and other beneficial activities. The coverage for these services varies among insurance plans. While some plans might fully cover these ongoing treatments acknowledging their significance, others might offer limited coverage or restrict it to specific types of post-treatment services. Some plans might exclude it entirely.

We accept most health insurance plans

We can help you verify your benefits and get you a clear picture on your residential mental health program coverage details.

Facility and Treatment Options

-

Does my insurance cover both local and out-of-state behavioral facilities?

Most insurance plans tend to cover local or in-network facilities more extensively because they have established contracts with these providers to offer services at reduced rates. Coverage for out-of-state or out-of-network facilities can be more limited, potentially resulting in higher out-of-pocket costs for the patient. However, some PPO (Preferred Provider Organization) plans might offer more flexibility, allowing members to seek treatment both in and out-of-state with varying levels of coverage. HMO (Health Maintenance Organization) plans, on the other hand, often require members to use in-network providers unless there's a specific medical reason to seek care out-of-state, or if such services are not available locally.

-

Is coverage available for luxury or executive rehab centers?

When considering luxury mental health treatment programs, the extent of insurance coverage can differ. These upscale facilities often provide amenities like private accommodations and exclusive therapies, which can mean higher costs. While many insurance policies cover essential mental health services, the additional luxuries might not always be included. However, select premium insurance plans might cater to such upscale facilities. Before settling on a facility, it's vital to review your insurance policy or consult your insurance provider to discern what is covered and the expenses you'll bear. The admissions team at the facility can also provide clarity on this matter. At Cornerstone Healing Center, we pride ourselves on offering a luxurious healing environment, inclusive of executive program tracks.

-

Does my plan cover alternative or holistic treatment methods?

When it comes to alternative or holistic treatment approaches, insurance coverage varies. Traditional methods with extensive evidence-based backing are typically the primary focus of many insurance plans. However, with the growing acknowledgment of holistic treatments in the medical community, some insurance providers are gradually incorporating these methods into their coverage. Holistic treatments often target the individual as a whole, rather than just addressing the symptoms. Before opting for a particular method, it's advisable to review your insurance details to determine what's covered. At Cornerstone, we offer a variety of holistic therapies accessible to all our clients, irrespective of their insurance plan.

-

Are family or couples therapy covered as part of my treatment?

Family and couples therapy plays an essential role in numerous treatment approaches, recognizing the widespread effects of mental health disorders on both the individual and those close to them. Cornerstone understands the importance of including family and loved ones in the healing process, offering family and couples therapy to all clients, irrespective of insurance specifics. While many insurance plans provide coverage for such therapy, the extent and conditions can differ. If you need assistance or clarity regarding insurance, Cornerstone's admissions team stands ready to guide you.

Treatment Frequency and Relapses

-

How Soon After Relapsing Can I Go Back to Treatment With Insurance?

Returning to a mental health facility when you need additional help is essential for your well-being. If you think you need to come back, you should always feel free to call and speak to admissions. Whether your insurance will cover another stay depends on your specific plan and the terms they set. Some plans have waiting periods between admissions, while others base it on "medical necessity." If a doctor or therapist believes you must return, your insurance will likely cover it. Remember, your mental health and safety are the top priorities, so always seek help when you feel it's needed.

-

Is there a limit to how many times I can go to a center with my insurance?

Returning to a mental health facility sometimes becomes necessary for various reasons. Whether it's a symptom relapse or the need for ongoing support, your well-being is crucial. If a doctor or therapist thinks you need more treatment, your insurance might cover it. Each plan has its own rules. Some might cover several stays in a facility or numerous therapy sessions each year. Other policies may require that you go to a lower level of care such as an outpatient mental health program. You must check with your insurance company to know exactly what's covered. If you ever feel the need to go back to a facility, prioritize your health and speak to professionals about the best steps forward.

Mental Health and Dual Diagnosis

-

Does my insurance cover co-occurring treatment?

Treatment for co-occurring disorders, when someone has two or more simultaneous mental health disorders, is seen as crucial by many health experts. Most modern insurance plans offer coverage for treating these combined conditions because they understand the link between them. Insurance companies must cover co-occurring or dual diagnosis treatment, especially when there is a substance use disorder involved. However, co-occurring disorders could also be two simultaneous mental health disorders such as ADHD and anxiety, which make it difficult to navigate daily life.

Cost and Payments

-

How do I check my deductible status?

Your health insurance deductible is a set amount you're responsible for paying before your insurance kicks in during the year. For instance, if you have a $1,000 deductible, you'll cover that amount in a given year before your insurance begins covering costs. To determine your deductible and your progress toward meeting it, you can refer to your insurance documentation. Most insurers maintain a platform where you can view specifics like your paid deductible amount and other related expenses. If this seems overwhelming or you're having trouble navigating, we offer assistance with insurance verification. Being informed about your deductible is important if you're contemplating entering a mental health treatment center, to avoid unexpected financial costs.

-

What is the co-payment or coinsurance for inpatient or residential services?

A co-payment, often called a "co-pay," and coinsurance are ways both you and your insurance split medical bills. A co-pay is a fixed fee for a medical service. Like, if you see a doctor, you could have a $25 co-pay, regardless of the visit's actual cost. Coinsurance is different. It means you pay a portion of the total bill, often a percentage. For example, if insurance covers 80% of a bill, you'd handle the remaining 20% using coinsurance. When thinking about mental health treatment, the amount for co-pay or coinsurance can vary based on your insurance specifics. Your insurance can provide info on potential costs for various treatments. It's good to note that costs might differ if you choose a facility they have a deal with (in-network) compared to one they don't (out-of-network).

About Cornerstone

-

Is financial aid or a payment plan available if insurance doesn't cover all costs?

Understanding the costs of mental health services can be complex, especially when insurance doesn't cover the total amount. At Cornerstone Healing Center, we offer payment plans for those who qualify on a case-by-case basis. This approach allows patients to spread out the total cost over a period. Some facilities also provide financial assistance based on your income, assisting those who might struggle with the expense of treatment. It's vital to communicate directly with the treatment center about these options to ensure financial concerns are manageable for you to receive the necessary care.

-

Does treatment affect future insurance costs/coverage?

When considering mental health treatment, many people are concerned about its potential impact on their future insurance rates or the availability of coverage. Under the Affordable Care Act (ACA), health insurance companies can't refuse coverage or increase premiums based on a pre-existing condition, which includes mental health disorders. However, life or disability insurance might view past treatments for mental health issues differently, potentially leading to higher premiums or limitations on coverage. Also, some professions with stringent mental health guidelines might consider a history of therapy when determining eligibility. While these considerations are valid, it's crucial to prioritize one's mental well-being. If you have concerns about the implications of seeking mental health services on insurance, it's best to consult directly with insurance providers.

Treatment Outcome and Follow-up

-

Does insurance need progress reports to keep covering treatment?

Insurance companies often tie sustained coverage for mental health treatment to evident progress in therapy. This ensures the treatments they're funding are effective and benefitting the patient. Treatment centers, like Cornerstone, routinely assess patients and provide progress reports to insurance providers. These reports may detail therapy attendance, behavioral changes, therapeutic milestones, and more. Ideally, during therapy, your primary focus should be on healing and progress. The task of maintaining regular communication with your insurance provider is something that reputable treatment centers handle. There is no need for you to worry about providing information to your insurance company. If there's no discernible progress, insurance might reconsider the extent of the coverage.

-

Are post-rehab services like outpatient therapy covered?

Coverage for post-treatment services, such as transitional housing or outpatient counseling, varies considerably among health insurance providers and plans. Transitional housing, often viewed as an intermediary step between inpatient mental health facilities and full reintegration into daily routines, might not be directly covered by some insurance plans, as they're not always considered a medical necessity. However, outpatient counseling, which includes regular therapy sessions to maintain mental stability and address ongoing challenges, is typically covered, though the extent and conditions might differ. Insurance provisions for aftercare services like transitional housing or outpatient counseling can greatly differ depending on the specific health insurance provider and plan.

Privacy and Confidentiality

-

How does the insurance company protect my privacy when discussing my treatment needs?

Federal laws, including HIPAA, alongside an insurance company's privacy guidelines, ensure that your health details remain confidential when discussing treatment needs. This guarantees that your medical records and any discussions related to your care are protected unless you give express permission to share them. Many insurance companies have additional measures to enhance your privacy. However, it's always wise to ask directly about how your data will be handled and to voice any privacy concerns with both your healthcare professional and the insurance provider.

Additional Services and Support

-

Does my insurance offer telehealth or online counseling services for mental health?

Many people are curious if their insurance covers online services such as telehealth or online therapy for mental health concerns. With the rise of digital healthcare and the increased emphasis on remote services, many insurance companies now offer coverage for virtual therapy sessions, online support groups, and video consultations with mental health professionals. However, the specifics of what's covered and for how long can vary based on your insurance plan. It's crucial to review your policy or speak directly with your insurance provider to understand exactly what online mental health services are included.

-

Can I speak to helplines or counselors through my insurance for support?

Many insurance providers recognize the significance of immediate assistance for individuals facing mental health challenges. As a result, they often provide dedicated helplines or direct connections to counselors for guidance. These services are typically available around the clock, ensuring you can reach out whenever needed. Speaking with these professionals can help you understand what treatments are covered by your insurance, direct you to appropriate care, or provide immediate emotional support. If you're interested in these services, it's a good idea to review your insurance documents or visit the company's website. There, you'll locate the necessary contact details or information to access this assistance.

-

Is support/community mental health covered by my insurance?

Many insurance plans recognize the importance of support groups and community-based mental health programs as part of a comprehensive care approach. While some groups, like peer-led support circles or community outreach programs, are often free, others might involve costs, mainly if licensed professionals facilitate them. Depending on your insurance plan, there might be coverage for these therapeutic sessions or programs. Some policies might cover group therapy sessions led by licensed therapists, while others could cover broader community-based programs. It's essential to look into your policy specifics or talk directly with your insurance company to understand what types of community-based mental health services are covered.

Policy Changes and Updates

-

How often is my coverage for rehab and related services reviewed or updated?

Insurance providers typically review and update coverage for mental health treatments and related services periodically. This can coincide with policy renewals, updates in healthcare regulations, or new treatment methodologies emerging. Most insurance plans have an annual renewal phase where terms, coverages, and potential costs may be re-evaluated. Additionally, as new research emerges and evidence-based practices evolve, insurance companies may adjust the treatments they cover. It's essential for individuals to actively review any changes to their policy, especially during the annual open enrollment period or when notified of any modifications by their insurance company. This ensures you stay updated on the treatments and services covered and are aware of any changes in costs or limits. For specific details on how often your coverage is reviewed or updated, it's always a good idea to contact your insurance company directly.

-

How will I be informed of any changes to my rehab coverage?

Insurance companies are committed to informing their policyholders about any modifications to their mental health treatment coverage. Typically, policyholders are notified of these changes through mailed documents, email notifications, or messages on the insurance provider's online platform. These notifications highlight the specifics of the changes and when they will take effect. To stay well-informed, it's vital for individuals to regularly check their mail, email, and the insurance company's website or portal. If a patient is in inpatient or residential treatment for behavioral health, then that facility would advise you on changes.

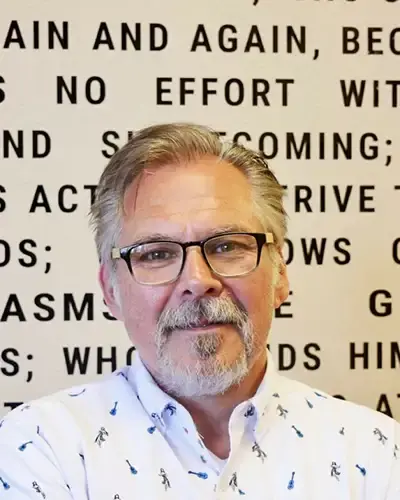

Meet Our Arizona Behavioral Health Team

Clinical Director of Scottsdale Program

Lionel is a Licensed Independent Substance Abuse Counselor (LISAC) with over 4 years at Cornerstone. Passionate about helping those with addiction and mental health struggles, and he has trained as an EMDR therapist, adopting a trauma-informed approach to find and treat underlying root causes with empathy.

Clinical Director of Phoenix Program

Nate began his recovery journey in 2010 and earned a Master’s in Social Work from ASU. He’s been in the Behavioral Health field since 2013. Specializing in CBT, DBT, and grief, Nate is now the Clinical Director of our Phoenix program, underlined by his passion for helping others who struggled with substance abuse issues as he did.

Still have questions about treatment?

Our admissions specialists are here to explain the process, answer any questions you may have, and ensure you’re getting the help you need to live a healthy life free from addiction.