Cornerstone

Understanding UMR Drug Treatment Coverage

Learn about using your UMR insurance policy to cover substance abuse treatment

Alcohol and Drug Treatment Coverage with UMR

When you or a loved one is facing the challenges of addiction, finding the right treatment and understanding your insurance coverage can be overwhelming. UMR is a third-party administrator (TPA) that partners with healthcare companies like UnitedHealthcare to provide members with access to a wide range of mental health and substance abuse treatment options, including drug and alcohol rehab.

In this guide, we’ll explore the ins and outs of UMR insurance drug treatment coverage so you can make informed decisions about your care. We’ll cover topics such as network coverage, claims approval, types of plans, deductibles, and hardships. By the end of this guide, you’ll better understand how to navigate your UMR coverage and take the first steps toward recovery.1

Jump to the following sections

View our addiction treatment locations

Addictions we treat at Cornerstone

UMR drug treatment coverage

In-Network

Out-of-Network

When considering addiction treatment, it’s important to understand the advantages and disadvantages of choosing an in-network provider with your UMR policy. In-network treatment centers have a contractual agreement with UMR and its partners, like UnitedHealthcare, which often means lower out-of-pocket costs for you. These providers have negotiated rates with the insurance company, resulting in reduced copays, coinsurance, and deductibles.

In-network providers have met UMR’s quality standards, ensuring that you receive appropriate care. However, the downside is that you may need more options when selecting a specific treatment center or location. Researching and confirming that the in-network facility offers care and services that align with your needs is crucial.2

Choosing an out-of-network treatment center using your UMR policy has its own set of pros and cons. One of the main benefits is that you have a wider selection of facilities, allowing you to prioritize factors such as location, specialization, and treatment philosophy. This flexibility can be precious if you’re seeking a specific type of care or environment that may not be available through in-network providers.

However, the financial implications of going out-of-network can be significant. You may face higher deductibles, copays, and coinsurance rates, and in some cases, you might be responsible for a larger portion of the treatment costs. It’s essential to weigh the potential benefits against the financial impact when considering an out-of-network provider and to discuss your options with both UMR and the treatment center.

Information about UMR Plan Types

Health Maintenance Organization (HMO)

UMR’s HMO plans typically require you to choose a primary care physician (PCP) who coordinates your care and provides referrals to specialists when necessary.

In most cases, HMO plans only cover treatment from in-network providers, except in emergencies.

While HMO plans often have lower monthly premiums and out-of-pocket costs, they offer less flexibility regarding provider choice.

Preferred Provider Organization (PPO)

PPO plans offered by UMR provide more flexibility than HMO plans.

You can generally receive care from both in-network and out-of-network providers, although choosing an in-network provider usually results in lower out-of-pocket costs.

With a PPO plan, you don’t need to select a PCP or obtain referrals to see specialists.3

Exclusive Provider Organization (EPO)

UMR’s EPO plans combine features of HMO and PPO plans. Like HMOs, EPO plans typically don’t cover out-of-network care except in emergencies.

However, like PPOs, you usually don’t need to choose a PCP or get referrals for specialist care. EPO plans often have lower monthly premiums compared to PPO plans.

Point of Service (POS)

UMR’s POS plans blend aspects of HMO and PPO plans.

You’ll need to select a PCP who coordinates your care, but you can see out-of-network providers if you’re willing to pay higher out-of-pocket costs.

Seeing in-network providers or obtaining a referral from your PCP generally results in lower costs.

High Deductible Health Plan (HDHP)

UMR’s HDHP plans feature lower monthly premiums but higher deductibles than other plan types.

These plans can be paired with a health savings account (HSA) to help cover out-of-pocket expenses.4

Once you meet your deductible, your plan starts sharing the cost of covered services.

Medicaid & Medicare Plans

UMR also offers managed care plans for Medicaid and Medicare beneficiaries.

These plans are designed to coordinate care and provide additional benefits beyond what’s typically covered by standard Medicaid and Medicare programs.

Eligibility and coverage details vary by state and plan type.

Understanding Policy Terminology

Deductible

Co-Insurance

Out-of-Pocket Max

A deductible is the amount you pay for covered healthcare services before your UMR insurance plan starts to pay. For example, if your plan has a $1,000 deductible, you must pay the first $1,000 of covered services yourself.

Once you’ve met your deductible, your insurance will share the cost of covered services according to your plan’s coinsurance or copayment requirements. It’s important to note that some plans may have separate deductibles for in-network and out-of-network care, and not all services may be subject to the deductible.

Co-insurance is the percentage of the cost you pay for a covered healthcare service after you’ve met your deductible. For instance, if your UMR plan has a 20% co-insurance and you’ve already met your deductible, you’ll pay 20% of the allowed amount for a covered service while your insurance pays the remaining 80%.

Co-insurance percentages can vary depending on the type of service and whether you receive care from an in-network or out-of-network provider.

The out-of-pocket max, or the out-of-pocket limit, is the most you’ll have to pay for covered healthcare services in a plan year. This includes your deductibles, co-insurance, and copayments. Once you reach your out-of-pocket max, your UMR insurance plan will pay 100% of the allowed amount for covered services for the remainder of the plan year.

Like deductibles, some plans may have separate out-of-pocket limits for in-network and out-of-network care. Understanding your plan’s out-of-pocket max is crucial, as it provides a safety net against high medical costs.

UMR Approval Process for Treatment

Verification

Submission

Adjudication

Payment

Appeal

Before beginning addiction treatment, the first step is to verify your UMR insurance coverage. The treatment center you choose will contact UMR to confirm your active policy and determine the specifics of your coverage, such as deductibles, copayments, and co-insurance. They will also inquire about any prior authorization requirements for the services you need.

Once your coverage is verified, the treatment center will inform you of any out-of-pocket expenses you may be responsible for, helping you understand what amount you will have to pay (if any) to get treatment. To streamline this process, you can provide your insurance information to the treatment center in advance.

After you receive treatment services, the treatment center will submit a claim to UMR on your behalf. This is part of the claims process, where the treatment center provides detailed information about the services provided, such as the dates of treatment, the types of services rendered, and the associated costs.

The treatment center’s billing department will handle the claims submission process, ensuring that all necessary documentation is included and the claim is submitted promptly. In most cases, claims are submitted by the treatment center you choose, allowing you to focus on your recovery while they handle the administrative tasks.

Once UMR receives the claim from the treatment center, they will review it to determine if the services provided are covered under your plan. This process is called adjudication.

During adjudication, UMR will verify that the services were medically necessary, that an eligible provider provided them, and that they fall within the terms of your coverage. If the claim meets all the necessary criteria, UMR will approve the claim and proceed with payment.

If your claim is approved during adjudication, UMR will issue payment to the treatment center according to your plan’s coverage terms. This payment will be made directly to the treatment center, and you will be responsible for any remaining out-of-pocket expenses, such as deductibles, copayments, or co-insurance.

The treatment center will then bill you for these remaining costs. Understanding your financial responsibilities before beginning treatment is important to avoid any surprises down the road.

If your claim is denied during adjudication, the treatment center’s billing department will typically file an appeal on your behalf. Treatment centers are well-versed in handling denials and will do their best to ensure that denied services are eventually paid. If necessary, they will gather additional documentation and present a strong case to UMR for why the denied services should be covered.

Treatment centers generally strive to provide only those services likely to be approved by your insurance in the first place, minimizing the risk of denial. However, if a denial does occur, you can trust that the treatment center’s billing department will work diligently to resolve the issue and secure payment for the services you received.

Get Help Paying Your Deductible

File a Hardship With UMR

If you’re struggling to pay your deductible, you may be able to file a hardship with UMR.

A hardship is a situation that prevents you from being able to afford your medical expenses, such as job loss, unexpected expenses, or a serious illness.

To file a hardship, you must contact UMR directly and provide documentation of your financial situation.

If approved, UMR may reduce your deductible or offer a payment plan to help make your treatment more affordable.

Assistance Programs & Payment Plans

Many addiction treatment centers offer assistance programs and payment plans to help make treatment more accessible.

These programs may include sliding-scale fees based on income, scholarships, or financing options.

Some treatment facilities may offer financing options, such as payment plans, to cover the cost of treatment.

This may involve taking out a loan or setting up a payment plan with the facility.

When considering a treatment center, ask about any available assistance programs or payment plans to help you manage your out-of-pocket costs.

Community Resources & Charitable Organizations

Sometimes, community resources and charitable organizations can help you cover your deductible for addiction treatment.

These organizations may include local non-profits, faith-based groups, or foundations dedicated to helping individuals access healthcare services.

Some organizations may have specific programs to assist with addiction treatment costs, while others may provide more general financial assistance.

It’s worth researching local organizations in your area to see if they offer any help with treatment expenses, such as grants or scholarships for individuals seeking treatment for substance use disorders.

FAQs About Using UMR Benefits to Pay for Alcohol and Drug Treatment

What types of addiction treatment does UMR cover?

How do I know if a treatment center is in-network with UMR?

Will I need to get pre-authorization for addiction treatment?

In many cases, you will need to obtain pre-authorization from UMR before starting addiction treatment. This means that UMR will review your case to determine if the proposed treatment is medically necessary and covered under your plan. Your chosen treatment center can help you navigate the pre-authorization process.

How much will I have to pay out-of-pocket for addiction treatment?

Your out-of-pocket costs for addiction treatment will depend on your specific UMR plan. Factors impacting your costs include deductibles, copayments, coinsurance, and the maximum out-of-pocket. You can contact UMR or your treatment center to understand your potential out-of-pocket expenses better.

What happens if UMR denies my claim for addiction treatment?

If UMR denies your claim for addiction treatment, your treatment center will likely file an appeal on your behalf. The appeals process allows the treatment center to provide additional information and argue why the services should be covered. If the appeal is successful, UMR may reverse its decision and provide coverage for the treatment.

Sources

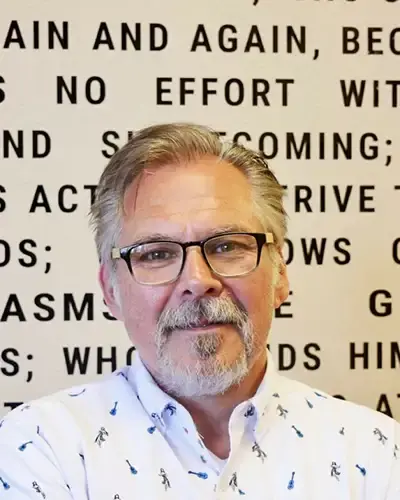

CLINICALLY REVIEWED

Lionel Estrada, LISAC

CLINICAL DIRECTOR

Lionel, our Clinical Director is a Licensed Independent Substance Abuse Counselor (LISAC) with over 4 years at Cornerstone, specializes in addiction and mental health. Trained in EMDR therapy, he employs a trauma-informed, empathetic approach to address the underlying causes of these issues.

- Read our Editorial Policy

Still have questions about treatment?

Our admissions specialists are here to explain the process, answer any questions you may have, and ensure you’re getting the help you need to live a healthy life free from addiction.